Power, trust and the Household Charge

On Monday afternoon, psychology and economics professor Erich Kirchler gave an interesting seminar here at the Kemmy Business School on the factors that affect taxpayer compliance or evasion. He finds two dimensions – power and trust – impact on the overall tax take. If the taxing authorities are seen to have high power, unsurprisingly this will mean greater compliance with tax laws. However it is equally important, particularly for self-assessment, that there is high trust in the system. If taxpayers don't trust the authorities to use tax revenue properly, then the level of taxes raised will fall. By Sheila Killian.

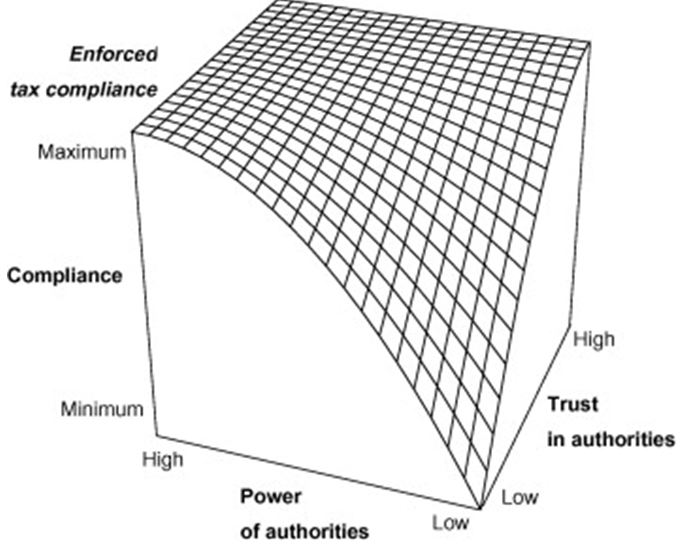

Professor Kirchler mapped the overall tax take along these two dimensions as a "slippery slope" that looks like this:

Source: Journal of Economic Psychology, Volume 29, Issue 2, April 2008

You can see how the ability of a country to raise taxes falls away if the power of the authorities, the trust in authorities or both are reduced.

Voluntary compliance is very a delicate thing, requiring a public understanding of the role of taxes in maintaining society. It's very difficult to foster, particularly in a post-colonial society. In Ireland, only a few generations ago, to avoid your taxes was seen as a patriotic act of rebellion, and to pay was seen as funding the oppressor. We have an emerging maturity about taxes, visible in the way in which tax evaders are publicly criticised now, but this new understanding is shockingly easy to damage.

In Ireland, the fact that the household charge became the focus of the protest against austerity indicates that it has been damaged here. Since there is no sign that people believe the authorities have less power than before, it follows that trust in the system has been lost somehow, in a way that relates to the austerity measures, and the public discourse around them.

Some questions around this:

- If taxes in Ireland are seen as being used primarily to repay banking debts which are seen as unfair, does this diminish the overall trust people have in the tax system?

- How much does the artificial divide which has been created in the public mind between the public and private sectors degrade this trust?

- If the social norm becomes non-payment, even as part of a protest, will we reach a point on that slippery point beyond which it will be difficult to recover?

{jathumbnailoff}