A bad plan, and false arguments

If Michael Noonan's aim is to protect the living standards of the highest income groups in the State while making the poorest suffer he's going the right way about it. By Michael Taft.

Michael Noonan’s comments justifying VAT increases are deeply worrying. They evince either considerable unfamiliarity with basic economic facts, or considerable indifference to such facts in pursuit of a particular agenda. Here’s what he had to say on RTÉ (22 minutes in):

“It (the VAT increase) will apply to everybody who purchases things but obviously rich people have a lot more disposable income than poor people and rich people will buy a lot more and will pay a lot more VAT. There’s no VAT of any sort on food and poor people spend a very large proportion of their budget on food so it will not impact as much on the poor as on the well-off people.”

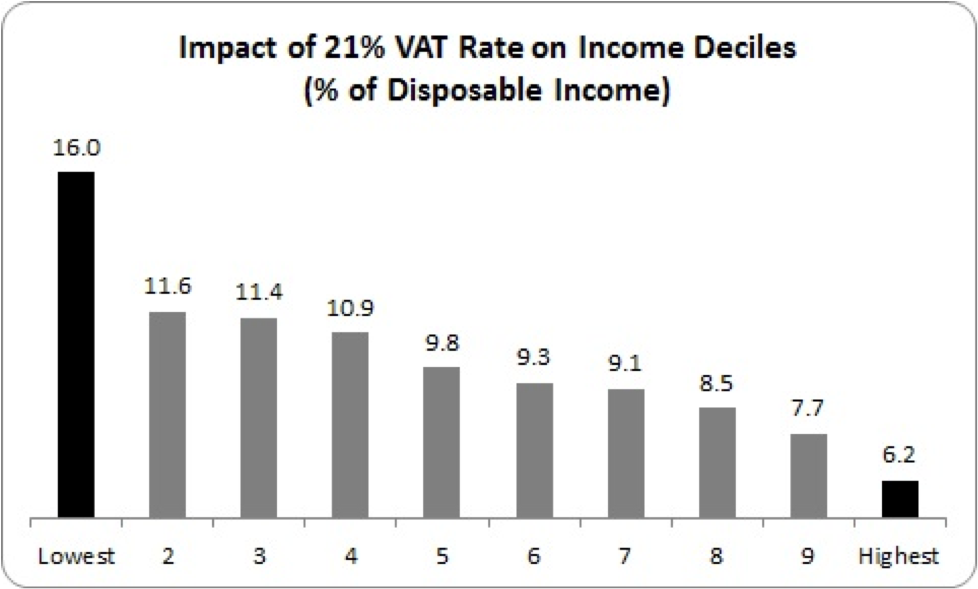

This is wrong. Full stop. It is well known that consumption taxes impact on lower income groups more as they consume most of their income. Indeed, the minister (or his advisors) would be well aware of a recent study published in the Economic and Social Review in the summer - The Distributional Effects of Value Added Tax in Ireland - by ESRI researchers Eimear Leahy, Sean Lyons and Richard Tol. They studied the impact of VAT and VAT rises on income deciles – from the lowest 10% income to the top (this is a tabular estimate of Figure 10 in the report).

Unsurprisingly, the 21% VAT rate has a greater impact on the disposable income of the lowest income groups (16%), compared to the highest income groups (6.2%). Again, unsurprisingly, average income groups also face a higher burden than high income groups.

This is consistent with the findings from the study by the Combat Poverty Agency/ESRI, which showed that ten years ago total VAT and excise taxes made up more than 20% of the gross income of the lowest decile, compared to less than 10% of the highest income groups.

So the 21% VAT rate hits the lowest income households by more than two-and-a-half times more than the highest income groups. So much for the minister’s claim.

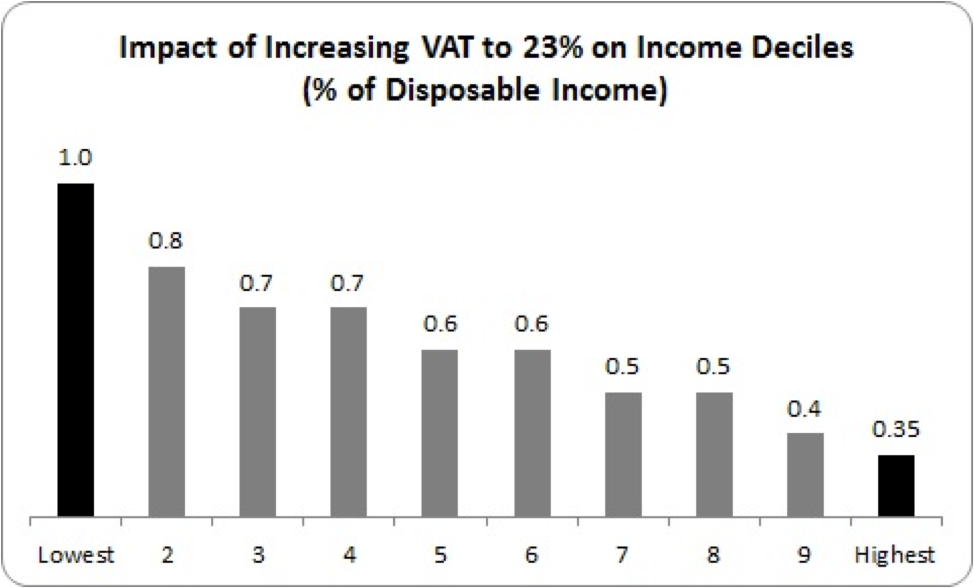

But the ESRI researchers also measured the impact of increasing the VAT rate to 23% – as the Michael Noonan is proposing (again, a tabular estimate of Figure 10 in the report).

Increasing VAT will impact harder on lower income groups – by 1% compared to less than 0.4% for higher income groups. Again, so much for the minister’s groundless claim that increasing VAT “will not impact as much on the poor as on the well-off people.”

Budget 2011 was bad enough. The low-paid were disproportionately hit through the introduction of the Universal Social Charge and the reduction of personal tax credits (which amounted to a flat-rate increase in income tax).

But the minister’s planned VAT rate is even worse for it will not just hit people at work. It will hit everyone, including those on social protection payments (pensioners, widows/ers, the unemployed, lone parents, etc). And the lowest decile group is made up of people living in some of the worst forms of absolute deprivation.

All this has to be set in the wider context. This year, social protection recipients of working age (that is, excluding pensioners) saw their real payments – after inflation – fall by 5.2%. Whatever about the leaks regarding Budget 2012, we can reasonably assume that social protection payments will not increase. With the Government’s projected inflation rate, real payments will fall by 1.2%. That’s just a start.

Now add in the VAT increases and real incomes will fall further. And that’s before the myriad of cuts and freezes are applied to child payments, rent and mortgage supplements, etc. It’s looking like another grim year for the poorest in society.

If I were Minister for Finance and wanted to protect the living standards of the highest income groups in the State, I would be doing exactly what Michael Noonan is doing – increasing VAT and introducing flat-rate taxes on households. That’s the ticket.

The question is – why would Labour ministers let him do it? {jathumbnailoff}