Flying blind in a storm without radar or fuel

Michael Noonan's version of "informed debate" seems to involve complete ignorance as to the effects of his proposed budgetary measures. By Michael Taft.

The Minister for Finance has said there was a need to have “an informed debate” on the issue of the proposed VAT rises, and “not simply resort to rhetoric”. No one would disagree except that only a day later the Minister admitted, in response to a query by Fianna Fáil’s Michael McGrath, that the Government did not take into account the impact on consumer demand of a VAT rise. This is an incredible statement.

Already, the Minister has stated that “the poor” wouldn’t be much affected by a VAT rise. However, ESRI researchers found the complete opposite. The lowest 10% income group pays out 16% of their disposable income on VAT; the highest 10% pays out 6%. The increase in VAT will hit the lowest income group approximately three times harder than the highest income groups. There is nothing new in this – it is commonly accepted that consumption taxes hit lower-income groups harder because they consume a higher amount of their income.

Now the Minister concedes that his “informed debate” is missing a crucial element – the estimated impact on consumer demand. If demand falls, GDP falls, employment comes under pressure, the Live Register increases, etc.

In effect, the Minister is admitting that his department doesn’t have a model (or didn’t think it was worthwhile) to estimate the impact of raising VAT on the economy.

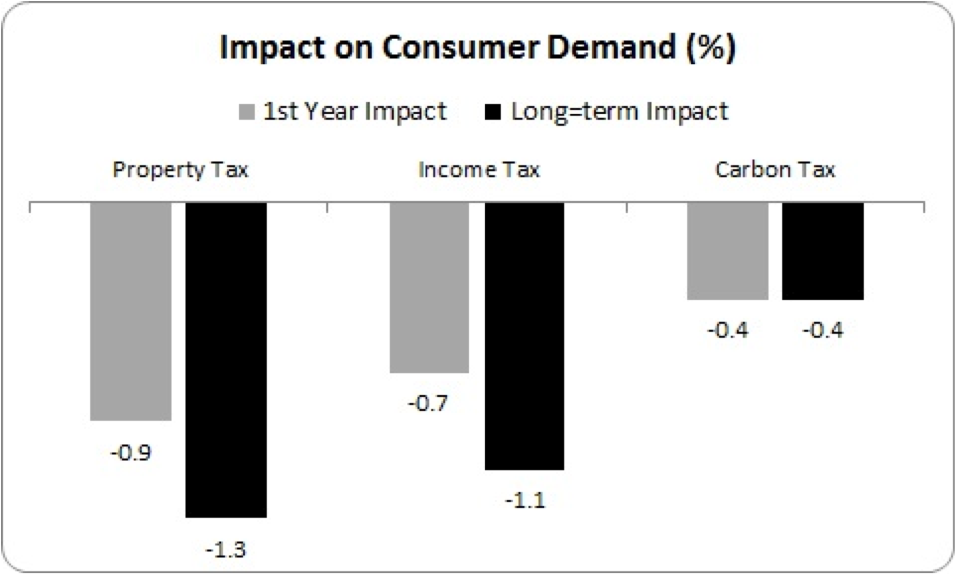

The ESRI has measured the impact of three different tax rises on consumer demand: income tax, property tax and carbon tax. If the rises are intended to raise €1 billion, this is their projected impact.

All tax measures reduce consumer spending. Introducing a property tax has the most negative effect – though, overall, it is less deflationary when other factors are accounted for (employment, business output, etc). The point is, however, that such tax increases can be measured.

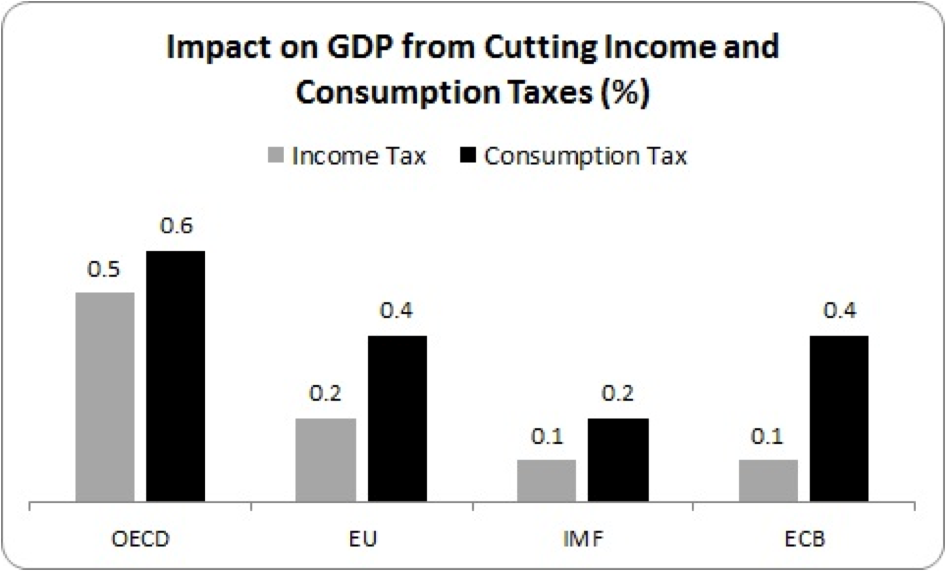

Unfortunately, the ESRI didn’t measure the impact of a VAT rise. So let’s turn to the IMF compilation of estimates of the impact of various measures on the economy. There are some problems here – the IMF only measures the impact in the form of a temporary cut in taxes, to assess their ability to stimulate the economy. In other words, what the short-term impact of cutting income tax or consumption tax for a year is.

Nonetheless, if a tax cut impacts more beneficially on the economy, we can reasonably assume – even as a working hypothesis – that the tax rise will impact more negatively. So how does an income tax cut compare with a cut in consumption taxes?

As seen, cutting consumption taxes has a more beneficial impact on the economy – in the short-term anyway – than income tax. Therefore, it is reasonable to assume that the reverse is the case.

This should not be too surprising. VAT is more regressive and reduces the spending power of those likely to spend all their income, whereas income tax reduces progressively the incomes at the higher end, where the impact on demand is more limited because they don’t spend all their income.

All this suggests that the impact on consumer demand from raising VAT will be more negative than what the ESRI estimated for income taxes. In other words, raising VAT will be highly damaging to economic growth. Now consider that many businesses will come under pressure, especially as the Government has already estimated that consumer spending will fall next year, flatline in 2013 and not return to growth until 2014. This is on top of substantial falls in consumer spending since 2008.

As I said, this is not wholly satisfactory but it is an attempt to inject some evidence into what the Minister has called for – an informed debate.

Of course, the Minister could correct this situation by simply requesting that the Department of Finance model the comparative impacts of tax rises. Instead, when asked by a TD, the Minister for Finance has effectively replied:

“I’m raising VAT but I have no idea what the impact will be on consumer demand or on the economy.”

We are flying blind in a storm without radar. And the fuel gauge shows we are quickly running out of juice. {jathumbnailoff}

Image top: rendebbie.