Opening up a new debate on social insurance

Ireland is a ‘low-insured’ economy. When it comes to both contributions and benefits this country is a laggard. What is needed is a long-term strategy that transforms social insurance from a mere ‘safety net’ to a welfare state that provides social and economic certainty to all workers. By Michael Taft.

Long-time readers will know that I’ve been hammering away for some time at our low level of social insurance. Minister for Social Protection, Joan Burton has also started making noises on this theme. Good. The problem with the structure of Irish taxation is not that it is necessarily low-taxed (it isn’t). Rather, it is low-insured. We pay in little, we get little and we end up with a big hole in our public finances and considerable levels of social and economic uncertainty.

Let’s first run through some comparisons.

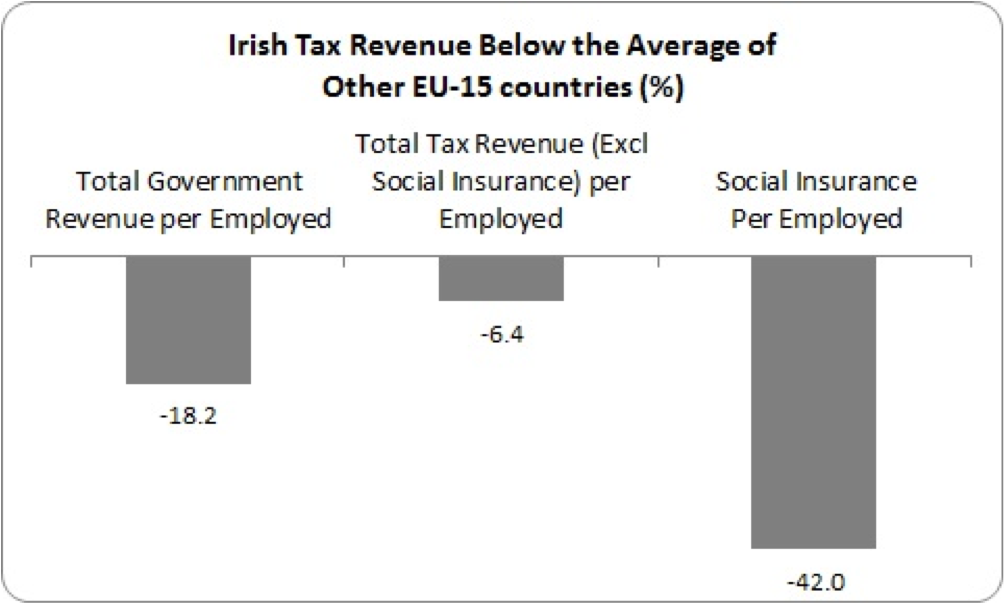

As seen, total Irish tax revenue per employed person is well below the EU-15 average – ranking 11th. If you just looked at this measurement you’d conclude that Ireland was a low-taxed economy.

As seen, total Irish tax revenue per employed person is well below the EU-15 average – ranking 11th. If you just looked at this measurement you’d conclude that Ireland was a low-taxed economy.

However, when you exclude social insurance contributions we see that Ireland is about average taxed – only 6% below the average of other EU-15 countries. This includes all taxes except for PRSI.

It’s when we get to social insurance that we find where Ireland falls down. We’re a ‘low-insured’ economy. When it comes to both contributions and benefits (earnings-related unemployment payments, pensions, health insurance), Ireland is a laggard.

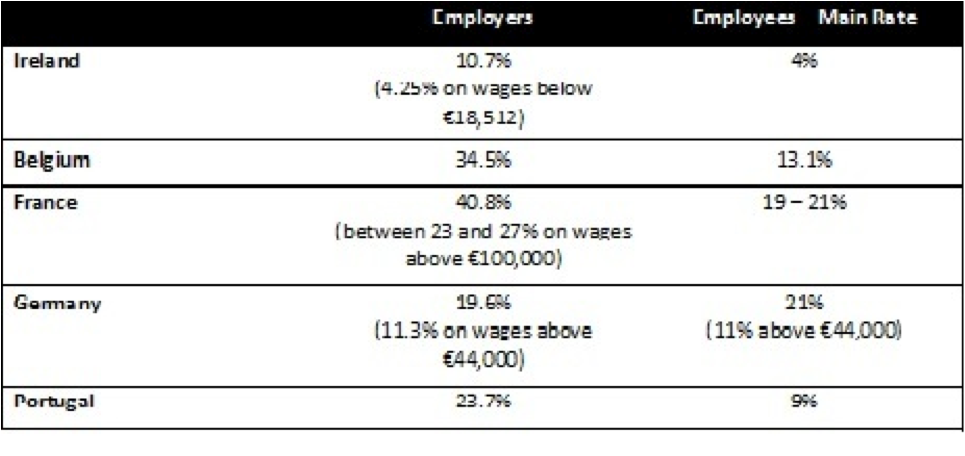

We can see why we fall down on social insurance revenue. Here are some selected social insurance rates.

For the self-employed, rates are one of the lowest in the EU-15.

In most other countries, social insurance is not just another revenue-raising mechanism – like VAT or income tax. It constitutes an insurance contract; for the contributions you pay, you receive x amount of benefits. This means that in many countries, a far greater amount of social expenditure – on health, pensions, income support – is paid through the equivalent of our Social Insurance Fund and not through the central government’s exchequer.

The Irish debate over revenue and expenditure is too focused on income tax and corporation tax. These tax categories do not play as important a role in other EU economies as they do here – owing to their more developed social insurance systems.

For instance, in Germany employees’ social insurance makes up 75% of personal income tax. In Austria it makes up 60%. In Ireland, it makes up less than 15%.

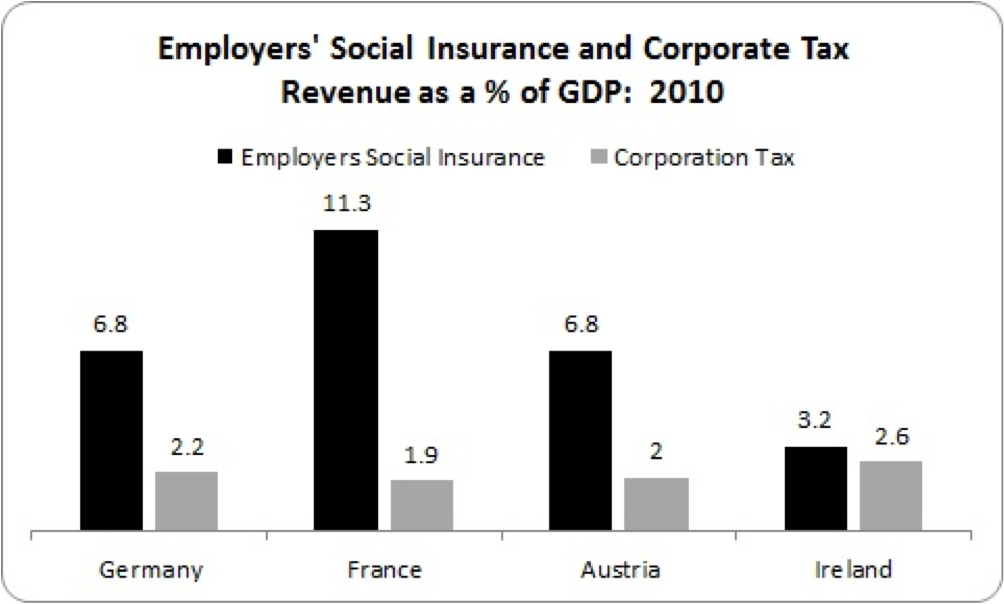

When it comes to employers’ social insurance, the contrast is even sharper.

On the continent employers pay more in social insurance than they do in corporation tax. Of course, employers’ social insurance is not a ‘tax’ as such – it forms part of the workers’ ‘social wage’. If you look at the CSO’s Survey of Income and Living Conditions, you’ll see that employers’ PRSI is counted as part of household income. Employers pay social insurance and workers receive health care, pensions and income supports in return – at least in other countries.

On the continent employers pay more in social insurance than they do in corporation tax. Of course, employers’ social insurance is not a ‘tax’ as such – it forms part of the workers’ ‘social wage’. If you look at the CSO’s Survey of Income and Living Conditions, you’ll see that employers’ PRSI is counted as part of household income. Employers pay social insurance and workers receive health care, pensions and income supports in return – at least in other countries.

In Ireland, our social wage is very small (and the corporation tax revenue is flattered by the fact that a large proportion is not a tax on profits created in Ireland, but in other countries; it ends up here via transfer pricing).

So what should progressives look for? If increasing PRSI is just a revenue-raising device, then this will do long-term damage to the concept of a ‘high-insured’ economy and the social wage. In normal times, social insurance benefits are paid out of this fund and constitute no charge on the Exchequer because it is paid out of contributions from employers and employees.

However, since the recession hit, the Social Insurance Fund has collapsed – more Jobseekers’ Benefit payments, lower contributions arising from fewer people at work and firms going bust. Currently, there is a €1.5 billion hole in the Social Insurance Fund – which has to be subsidised directly by the Exchequer. If plugging this hole (and, so, reducing government spending) is the prime motivation behind increasing PRSI rates, it will be seen as just another tax.

What is needed is a long-term strategy that transforms social insurance from a mere ‘safety net’ (a net with lots of holes in it) to a welfare state that provides social and economic certainty to all workers – providing free health care, earnings-related pensions and earnings-related unemployment and related payments.

Increasing PRSI on low/average income employees would be damaging to growth and domestic demand and should only be considered in the context of rising wages. This doesn’t mean we can’t increase PRSI revenue. We could start with low-impact measures:

- Extend PRSI to capital income (capital gains and inheritances/gifts). If this was done on gross income, just like labour, it could raise a significant amount. There’s no reason in equity why social insurance contributions shouldn’t come from all income, rather than just labour.

- Extend social insurance contributions to all income, similar to the Universal Social Charge. The PRSI levy of 4% takes in less than half of what the USC takes at a rate of 7 percent takes in. This isn’t about hitting low incomes but removing reliefs from PRSI which benefit high earners.

- Reverse the cut in the employers’ low rate of PRSI. It is ridiculous to provide a PRSI subsidy to employers who are cutting employment. In the medium-term, phase out any reduced PRSI for low-paid workers. This is a distortive measure that incentivises part-time rather than full-time work – to the detriment of workers and the Exchequer.

- Proceed with the minister’s plan to require employers to pay for the first four weeks of sick pay.

These measures, which could be introduced over the next two years, would help reduce the hole in the Social insurance Fund and, so, public spending.

In the long-term, PRSI rates should be increased in line with benefits to average EU levels. If employees’ PRSI is increased by 1%, introduce an earnings-related unemployment benefit. Health insurance should be paid through the social insurance system, which would be far more progressive than requiring everyone to buy health insurance on the private market. Redirect the massive tax subsidies to the private pension industry into a second-tier earnings-related pension.

This is a vision that can start to mobilise a majority in society. People will be guaranteed free health care, strong income support in case of job loss or illness, and a good retirement income.

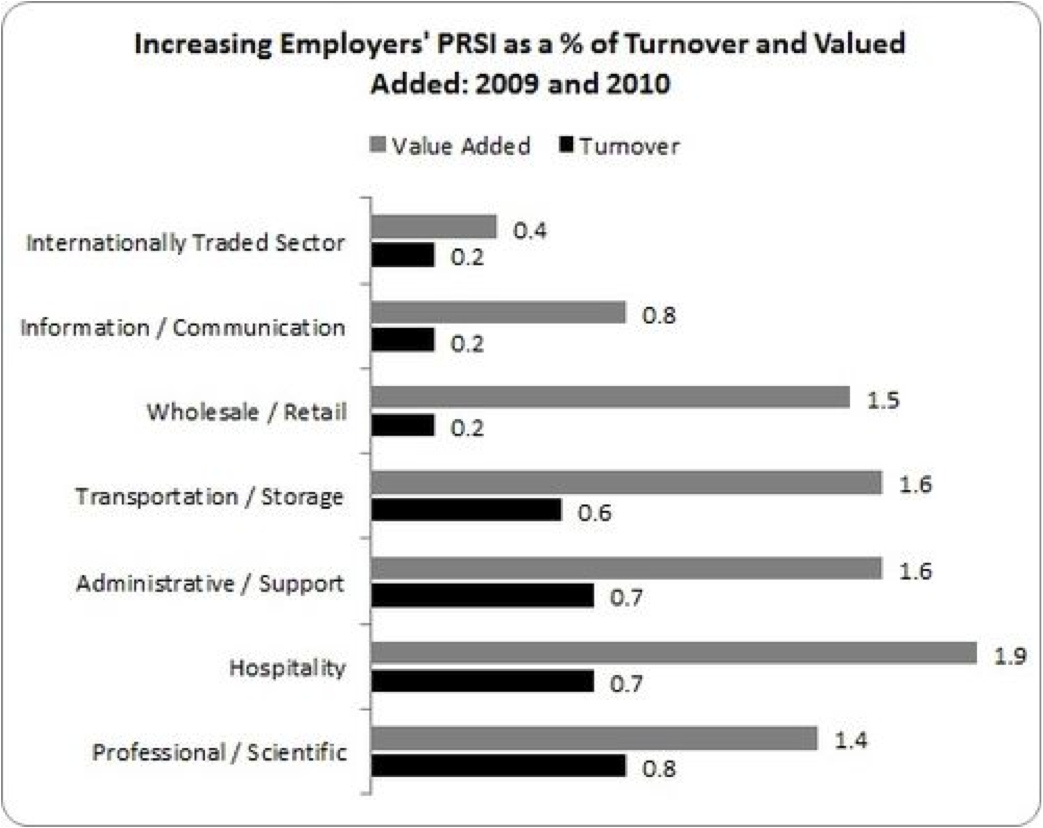

And this means starting to raise employers’ PRSI – or the social wage. This is where the debate should start – not with the corporate income tax (though we will have to deal with that eventually). Would this be an onerous burden on businesses? Let’s assume a modest increase of 2.5% in employers’ PRSI.

The cost of increasing employers’ PRSI by 2.5% would have only a fractional impact on turnover but a slightly higher impact on value added for domestic sectors. A number of caveats are needed here, though. First, data for all sectors is 2009 while the internationally traded sector (manufacturing and services) is from 2010. We don’t have numbers for last year or estimates for this year. Second, this measures an increase in one year; in reality it would be phased in over two to three years. Third, any phasing in would need to be grounded in full data on enterprise health in particular sectors.

The cost of increasing employers’ PRSI by 2.5% would have only a fractional impact on turnover but a slightly higher impact on value added for domestic sectors. A number of caveats are needed here, though. First, data for all sectors is 2009 while the internationally traded sector (manufacturing and services) is from 2010. We don’t have numbers for last year or estimates for this year. Second, this measures an increase in one year; in reality it would be phased in over two to three years. Third, any phasing in would need to be grounded in full data on enterprise health in particular sectors.

What this shows, though, is that increasing social insurance or the social wage is not the ‘burden’ many would allege.

The point of all this is that we should move away from arguments about increasing income and corporate tax rates. We should, instead, put more of our focus on social insurance – not only just on contribution levels, but on the range and quality of benefits.

Here’s a new slogan for progressives: a low-taxed, high-insured economy. That would really subvert the old stereotypes. {jathumbnailoff}